Executive Summary

The rapid growth of impact investing has brought new energy to the conversation about harnessing capital for social uplift. Impact investment has grown from a niche asset class to $715 billion of investments that seek both social impact and financial return in just over a decade.1

Download the executive summary

Download the full report

Now, more philanthropists, the experienced hands of social impact as grantmakers, are choosing to expand their philanthropic toolboxes beyond the grant by using impact investing tools in two important ways.

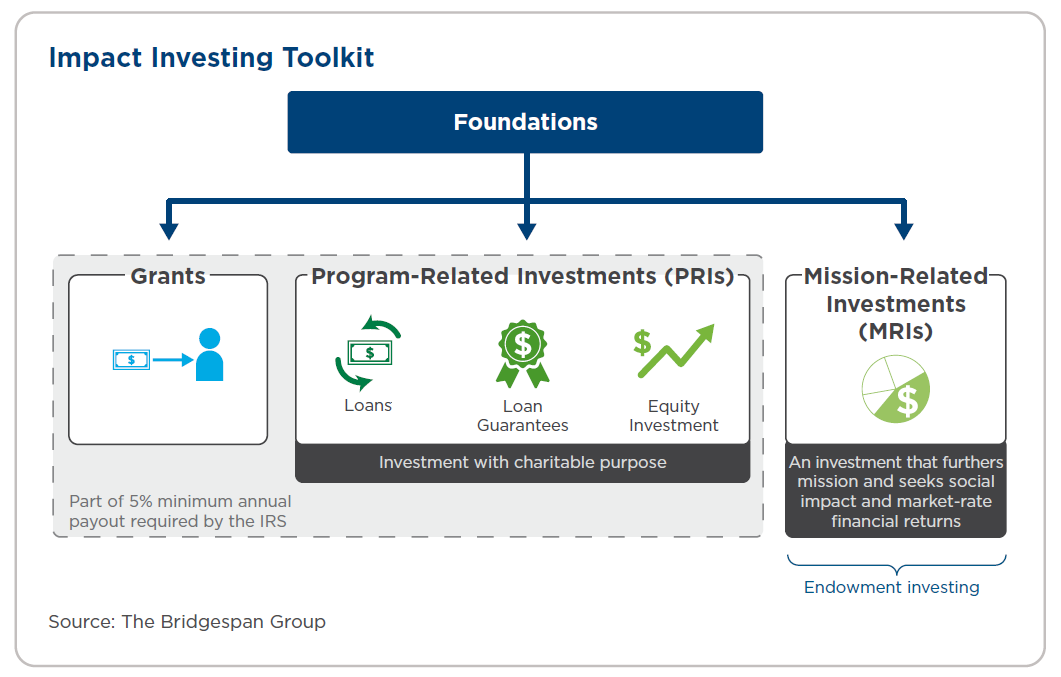

One way is to supplement their traditional grantmaking with other financial tools, such as loans, loan guarantees, and equity investments. These program-related investments(PRIs) further the foundation’s charitable purpose without having monetary gain as a primary motivation. Another is to make mission-related investments (MRIs) that sustain their endowments with competitive rates of return while, importantly, also advancing philanthropic goals. This represents a contrast with the ongoing practice of most foundations, which issue grants to pursue programmatic goals, and prioritize financial growth and prudence with their endowments.

This “Impact Investing Toolkit” chart summarizes the full range of investment options available to foundations.

Harnessing these tools could unlock novel collaborations while necessitating new ways of working. Like-minded foundations, for example, can take collaborative approaches to impact investing that might be particularly effective for both place-based investment in specific communities and systemic change initiatives. New ways of working typically involve investment teams and program teams establishing closer working relationships. This lays the groundwork for transitioning from a grant-centric to a holistic approach, one that reimagines foundations as asset managers for social good.

This research on the current state of impact investing in institutional philanthropy, conducted for The Kresge Foundation, included a review of literature and interviews with foundation leaders who shared practical, operational advice on impact investing.

For those considering a move from the sidelines, the experienced philanthropic impact investors we interviewed offered practical advice:

- Match investment tools to the problems you are looking to address.

- Consider ways in which you can use your full endowment (not just your annual disbursements) to generate positive social or environmental change.

- Make equity, racial and gender, a centerpiece of how you think about investing for impact. Indeed, early on, several foundations made racial equity an impact investing goal.

- Match your strategic ambition to your capabilities. Small investment teams should consider working with outside fund managers or limiting their scope to debt transactions. Larger teams can take on more complex guarantees and equity investments.

- When building an investment team, hire experienced impact investing professionals and encourage them to work closely with program teams to ensure investments align with programmatic objectives.

- Given the complexity of effectively deploying impact investing tools to achieve meaningful change, consider opportunities to collaborate with peers, particularly those with significant experience harnessing impact investing.

- Make the mindset shift from grantmaker to asset manager, taking a holistic approach to identifying the proper financial tool for the problem at hand.

Impact investing gives foundations tools to achieve social or environmental benefits that grants alone could never duplicate. The possibilities are limited only by the imagination— and the willingness of more foundations to embrace a new way of thinking and working.

1. Abhilash Mudaliar and Hannah Dithrich, Sizing the Impact Investing Market, Global Impact Investing Network, April 2019.