Executive Summary

Across sub-Saharan Africa, encompassing 48 countries and more than 1.2 billion people, Africa-based and -led investment fund managers work overtime to secure capital. It’s an especially difficult task for those that put social purpose alongside financial reward. “It’s hurdle, after hurdle, after hurdle, after hurdle,” says Polo Leteka, founder and chairman of IDF Capital, a Johannesburg-based investment and advisory firm. “And that’s what makes it prohibitive for a lot of fund managers, or potential fund managers, to get into this [impact investing] space.”

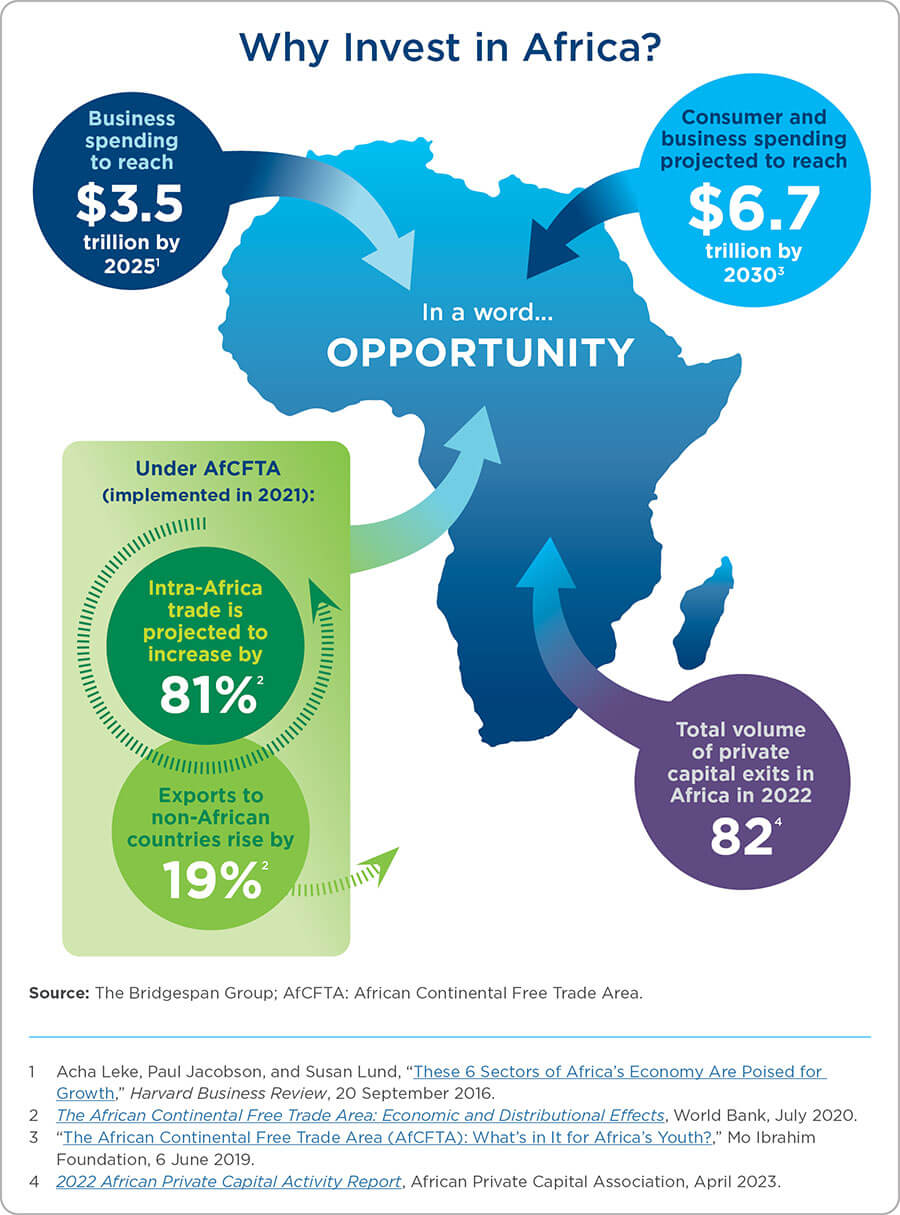

Lack of investable opportunities isn’t one of the hurdles, says Frank Aswani, CEO of the African Venture Philanthropy Alliance. “Across the world, there has never been a better time to be an impact player but, even more importantly, an impact player in Africa,” he adds. Investors are starting to get the message. The 2020 Global Impact Investing Network (GIIN) annual survey found that 52 percent of respondents planned to increase their allocations to sub-Saharan Africa.

To really find out what’s going on, however, it’s worth listening to the on-the-ground experiences of African general partners (or GPs). It’s the GPs who are responsible for making investment decisions and managing the day-to-day operations of funds. African GPs can and should play a prominent role in impact investing, whereby their proximity, lived experiences, networks, and leadership can inform how impact capital shapes the continent. So we interviewed 25 stakeholders, including African GPs, as well as private investors in limited partner (LP) roles, philanthropists, development finance institution professionals, field experts, and other impact investing intermediaries. In these discussions, we sought to understand the challenges that African impact fund managers face in raising and deploying capital and to elevate the solutions they believe are most needed.

In addition to noting challenges endemic to the market, such as currency volatility and limited exit opportunities, African GPs shared experiences that highlight three constraints to their access to impact capital:

- The traditional “rules” of due diligence work against African GPs receiving capital.

- The “impact” label deters, rather than spurs, investor engagement with African GPs.

- Impact-first capital is not reaching the African GPs who need it.

We also heard promising approaches that could inspire some LPs, in particular, philanthropists, family offices, and high-net-worth individuals, to invest in African GPs. These “first-mover” LPs have more autonomy to shift their investment practices than most institutional investors. Asset managers and owners with longer investment horizons and more flexible mandates might also fit in this category.

Many investors—private and philanthropic—seem reluctant to invest in African GPs. But African GPs are hard at work demystifying their markets and educating reluctant investors. And as more investors become first movers, they are seeing what Susana Garcia-Robles, senior partner of Capria Ventures, a long-time impact investor focused on GPs in the Global South, has seen for a long time: opportunity.