Help [donors] fulfill their vision for life...they all have a passion.

– Rick John, Chief Financial Officer and Senior Vice President, Finance & Administration

Overview

Related Content

How Nonprofits Get Really BigOrganization Profiles from How Nonprofits Get Really Big

Opportunity International (“Opportunity”) is a Christian ecumenical organization that creates jobs, stimulates small businesses, and strengthens communities internationally through micro-enterprise development. Opportunity runs 42 “implementing partners”? locally staffed lending organizations (often formally chartered banks) that make micro-loans to the poor. Individual clients receive small loans that average $144 and are then jointly responsible for repayment in a group called a “trust bank.” In 2004, the organization loaned $242 million to 675,500 clients worldwide, with a repayment rate of 98%.

Opportunity International draws its funding from three main sources: interest on its micro-loans, individual donations (largely from high net worth donors), and government funds (primarily USAID grants). Its fundraising pitch is complex and data-rich (reflecting the program itself), requiring sit-down, face-to-face conversations with potential donors. Twenty regionally-based marketing directors develop long-term relationships with high net worth donors, with each director typically raising $1.5 million per year once they have an established network of donors. Roughly half of individual donors are “faith-based,” acting out of a commitment that echoes Opportunity’s mission statement to follow, “Christ’s call to serve the poor.” The others often are motivated by Opportunity’s focus on entrepreneurship to solve problems of the poor.

Founding date: 1971

Revenue (2004): $88 million global ($29 million in the U.S.)

Structure: Network

NCCS classification: International affairs

Services: Provides business training, mentoring, financial planning, leadership development, and direct micro-loans to the poor, along with associated financial products (e.g., savings accounts, insurance, and bank cards)

Beneficiaries: Low-income working individuals (87% women) in the developing world

Leadership (selected): Christopher A. Crane, President and Chief Executive Officer; Rick John, Chief Financial Officer and Senior Vice President, Finance & Administration

Address: 2122 York Road, Oak Brook, IL 60523

Website: www.opportunity.org

Growth Story

- 1971 – Two future Opportunity International programs are founded in Latin America and Indonesia with grants from USAID, the Lilly Endowment, and private donations.

- 1974 – The two programs merge to become Opportunity International.

- Early 1990s – The Women’s Opportunity Fund (WOF) is created to help Opportunity move beyond its donor base of a few wealthy males to a broader base that better reflects the organization’s largely female client base in the developing world. WOF quickly grows to $1 million in annual donations. USAID funding interests shift to Eastern Europe and Africa following the fall of the Iron Curtain, providing Opportunity with a chance to expand into new geographies. Opportunity begins building a salesforce of marketing directors to create and maintain personal relationships with donors.

- 1992 – Opportunity broadens its focus to even lower income entrepreneurs, rolling out a group lending model.

- 1997 - 1998 – Opportunity launches a campaign to raise $3 million for use solely in the Philippines, with a goal of having a significant national impact. The project energized donors and staff, and shifts the organization’s goals from incremental gains to breakthrough impact.

- 2001 – Contributions drop 20% as private donors experienced losses in the stock market, forcing Opportunity to layoff staff and impose unpaid vacation. Management maintains its focus on major donations from individuals throughout and giving ultimately rebounds.

- 2003 - 2005 – An Africa project that Opportunity put on hold in 2001 is launched to address the link between poverty and AIDS. The organization raises $15 million of the $25 million goal by September 2005.

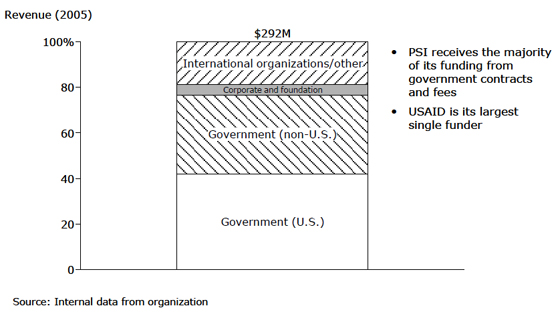

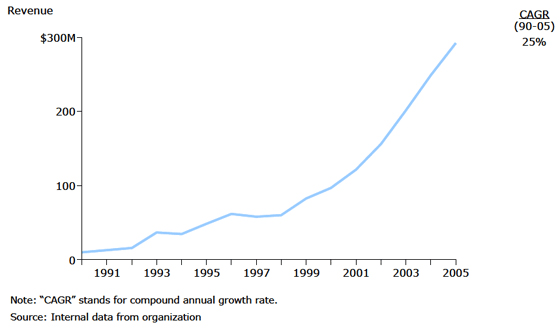

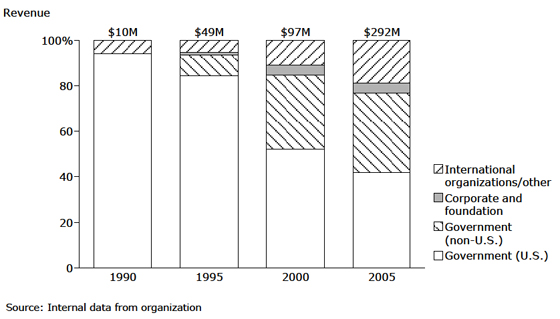

Revenue Trends

Revenue growth: Contributions have grown steadily over time. Earned income from micro-loan interest has tracked with the increasing the number of clients served.

Funding mix: U.S. individuals consistently have provided Opportunity’s contribution base, with the share from international donors and government growing gradually.

Opportunity’s individual contributions come predominantly from high net worth donors. Nearly 80% of individual dollars are from the 4% of donors who give at least $25K.

Actions That Helped Propel Growth in Funding

- Matched fundraising approach to program model. The complexity of Opportunity’s micro-enterprise model has lent itself to individual, one-on-one conversations with sophisticated donors. It has targeted self-made, high net worth individuals with a passion for ending poverty—individuals who tend to identify strongly with the micro-enterprise solution.

- Focused on donor relationships. To make Opportunity’s strategy of targeting a small group of large donors work, the organization has had to attract repeat donations year after year. Opportunity attributes much of its success on this front to its provision of great “customer service” to its donors.

- Avoided chasing off-mission dollars. Opportunity’s management has been thoughtful about taking large donations that could shift its emphasis. One donor offered $1.2 million if Opportunity would change its mission statement to refer to “God” rather than “Jesus Christ;” Opportunity refused.

- Measured its impact. Measuring impact has been an integral part of Opportunity’s strategy and fundraising approach. Opportunity marketing materials include data on the number of loan clients, average loan size, and repayment rates—all by country—to help give donors confidence that their donations will make a difference.

Funding Challenges

- Marketing a complex program model. The complexity of Opportunity’s program dictated its funding strategy to a large degree. The pitch for micro-enterprise involves data and evidence about how the poor leave poverty—material which is not appropriate for a 30-second ad or a direct mail campaign. Despite occasional forays into direct mail and other forms of mass marketing, Opportunity has always come back to its small base of high net worth donors.

- Satisfying funders’ geographic preferences. Individual-funded Opportunity needs to serve geographies that are linked to donor’s interests. At times the absence of such a donor has stymied the organization’s expansion plans.