(This article first appeared in Social Investor 2019, published by the Chandler Foundation.)

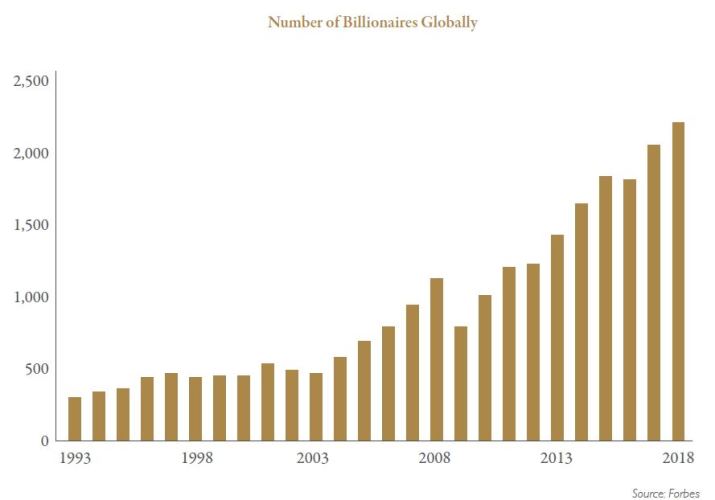

In 1993, there were 310 billionaires around the world; today, there are more than 2,200. Collectively, this group has more than US$ 9tn in assets, and their intent to invest for global good is well-known—just look at the 186 signatures on the Giving Pledge.

The New Normal in Philanthropy

History suggests this combination of enormous wealth and strong philanthropic ambition holds great promise. Philanthropy has repeatedly been the catalyst for major social advances, from eliminating age-old infectious diseases to securing important civil rights for repressed populations.

Yet there remains a yawning gap between the very wealthy’s current level of giving and their full philanthropic potential. In the US, families worth more than US$ 500m give an average of 1.2% of their wealth per year to philanthropic causes. If current appreciation trends continue, donors seeking to channel half of their wealth away within the next 20 years would have to contribute nearly 11% of their wealth annually—a nearly ten-fold increase over their current rate of giving.1 The gap only widens when it comes to addressing social and environmental problems. The primary motivation for 80% of donors is to create change in areas like these, but only 20% of their most significant gifts (gifts of US$ 10m or more) do so.2

Granted, the massive and visible expansion of wealth is not without concern. It has sparked a growing wariness of plutocracy. As part of these broader questions about the influence of wealth on society, both the action and inaction of philanthropists are receiving increased scrutiny. This puts a premium on philanthropy fulfilling its historic role and full potential—helping promising organizations and citizen-led movements surmount some of the world’s most pressing problems.

Allocation of Wealth

The next 25 years are “prime time,” as the majority of the highest-potential donors are in their mid-60s. There are two likely outcomes. In one, giving to the most promising opportunities grows dramatically, creating a renaissance of innovation and impact.

The other—and sadly, more probable—outcome is that the levels of giving advance modestly and focus on less-ambitious initiatives, leaving both society and donors disappointed.

History suggests that the current combination of enormous wealth and strong philanthropic intent holds great promise.

The barriers to dramatic growth in philanthropy emanate from both donors and NGO leaders. The large majority of philanthropists practice “peanut butter philanthropy,” spreading small gifts among many recipients. This approach yields an extremely inefficient giving marketplace, with little chance of donors fulfilling their personal goals or delivering big results for society.

At the same time, when major gifts are scarce, NGO leaders typically focus on near-term horizons—closing this year’s funding gap, or opening in one more city. The cumulative effect of these inefficiencies is not surprising: few social change organizations and initiatives are prepared to deploy big philanthropic investments to achieve major results.

Glimmers of Change

Major new donors are emerging. In 1993, the ten largest US foundations were a veteran group, with an average founding date of 1939; today, only two of those foundations remain in the top ten. Highly influential donors, including Michael Bloomberg, Pierre Omidyar, and Laurene Powell Jobs, are embracing new and innovative models, such as blending philanthropy and impact investing to achieve targeted outcomes and forming LLCs that enable a broader range of advocacy strategies. And long-standing foundations like Ford, MacArthur, and Hewlett are tackling some of the most challenging problems facing the planet-—climate change, inequality, and nuclear threats.

Indeed, the number of large, ambitious gifts addressing social change is growing. US donors made more than 70 gifts of US$ 25m or larger to social-change causes in 2017; in 2000, there were only 19 such gifts. There is strong growth globally, as well. Recent Bridgespan Group research found that of 90 major US and international donors’ giving to issues targeted by the United Nations’ Sustainable Development Goals, grants of US$ 10m or larger rose by more than 80% between the five-year spans ending in 2010 and 2015.3

However, even with these ascending trends, wealth accumulation is dramatically outstripping growth in philanthropy. There are three ways today’s donors can close this gap.

1. Help NGOs Create More Big Bet Opportunities

In our experience, only in rare instances do NGOs have the resources to invest deeply in developing the type of big bet opportunities donors seek – investment concepts with a specific goal for creating ambitious change in the world, backed up with a logical, believable path that will get them to that goal. Instead, in pitching donors, resource-constrained NGO leaders go back again and again to just one story: the problem is enormous, our organization is really terrific, more money will allow us to do more important work. But donors rarely find such vagueness compelling.

Donors can help break this unproductive pattern by inviting and supporting strong NGOs to think big and to chart what it would take to achieve impact at scale. In the places where we’ve seen ambition and strategy come together powerfully, there have been extensive co-creation of the investment concept between the donor and NGO. Take, for example, the partnership between the Einhorn Family Charitable Trust (EFCT) and City Year, one of the most well-known American nonprofits.

We stand at a truly pivotal time in the history of philanthropy. Never has wealth grown so fast and at such a scale as in the last two decades.

In the late 2000s City Year made a major strategic pivot to focus all of its national service work on schools, with a goal of nearly doubling the number of their students who reach 10th grade on track to graduation. Jennifer Hoos Rothberg, the executive director of EFCT, was a close working partner with City Year’s team. “They took a risk and let me participate in their thinking,” says Rothberg. “In working together on the thorny questions, we developed a shared understanding and collective willingness to take the risk inherent in targeting such an ambitious goal.” The collaboration culminated in 2012, with EFCT making a US$ 20m big bet on City Year as part of a core group of lead funders. The investment concept they had co-created was so compelling that other funders jumped on board to back the balance of the US$ 150m plan.

2. Join Matchmaking Platforms

In the for-profit sector, investors can turn to a massive financial services industry to identify investment opportunities. The same level of supportive intermediation simply has not existed in the social sector. We are seeing, however, the emergence of some major new initiatives that are playing this matchmaking function—building on a series of smaller efforts, such as New Profit, NewSchools Venture Fund, and Venture Philanthropy Partners, that started almost 20 years ago.

Some of these new efforts pool large sums from major donors and then invest deeply in surfacing big bet opportunities. For example, Blue Meridian Partners has raised US$ 1.7bn to apply to US organizations with the potential to achieve significant impact. Similarly, Co-Impact has aggregated more than US$ 400m to make big bets on global efforts. In other efforts, donors retain decision-making control. An example here is TED’s The Audacious Project, which has attracted more than US$ 400m of investment capital for seven “world-changing ideas.” The biggest limitation to these efforts is capital flow. Many more donors will have to opt in, in significant ways, for them to come anywhere near their full potential.

3. Give Big Now and Lean Into Risk

None of this can happen without donors moving more resources today, rather than waiting until tomorrow. Yet there are strong norms about risk-taking that impede this moment’s potential. The result is a tricky dichotomy: philanthropy provides the world’s “risk capital,” even as much of it remains in safe harbors.

In their for-profit lives, donors accept that some investments pay off and others don’t – and recognize that the ones that do pay off can take years to do so. But in their philanthropic lives, donors tend to want a high degree of certainty that their bet will succeed—and in relatively short order. However, success in the social sector is often the result of an iterative process, where solutions emerge through trial, error, and adjustment over long time periods.

The desire for certainty creates a natural temptation to think big but aim low—pushing big bet opportunities further and further out into the future. While it is true that big bets do not always yield big advances, small, cautious efforts rarely do.

Wealth has grown at a greater speed and scale in the last two decades than ever before. This offers an unprecedented opportunity for donors to help make the world a more just and thriving place – if they are able to apply as much energy, imagination, and boldness to their philanthropy as they do in their private-sector investments.