How Some Nonprofits Build Sales Teams on a Budget, By Matt Plummer and Vlad Nedelea, SSIR.org, Nov. 14, 2017

Explore more resources on selling social change >>

Today, Weight Watchers, Jenny Craig, the YMCA, and several hundred other community-based organizations offer the program. Upwards of 15,000 employer-sponsored health insurance plans and many of the nation’s largest health insurers cover the cost. (In a breakthrough, Medicare officials in March 2016 proposed expanding coverage to include DPP, a move that may inspire more employers and insurers to follow suit.)

Yet despite DPP’s proven impact and the collective efforts of all these organizations, only around 20,000 of the 86 million Americans who are pre-diabetic enrolled in programs last year—a disappointingly low number. The situation in New York state is a case in point. There, several hundred coaches trained to deliver DPP in 2013, but most sat idle for lack of demand.

DPP’s struggle to attract participants highlights a little-discussed issue that affects a wide range of innovative social programs. Just because there’s a clear need doesn’t mean there’s demand. We call this the “need-equals-demand” fallacy. And it’s widely felt.

Among nonprofit organizations responding to a survey by The Bridgespan Group, 70 percent reported shortfalls in program participation, and half said that matters have gotten worse over the past five years.[1] One nonprofit leader summed up the frustration experienced by many: “We have scaled up a [youth job-training] program we are very proud of, but people are not coming through the doors.”

Lack of demand is a particularly vexing issue for those organizations eager to achieve transformative scale—that is, to advance from incremental growth to a scale of intervention that can actually solve a social problem. Rigorously evaluated evidence-based practices and programs alone cannot trump beneficiaries’ lack of awareness or interest. Scale requires more than a program that achieves intended outcomes. Nonprofits and funders that aspire to achieve breakthrough results need to reject the notion that need equals demand. Rather, they must be prepared to actively generate demand for social change. Nonprofits must learn some of the same demand-generation techniques that for-profits have been honing for decades.

Building Demand with Design, Segmentation, Sales, and Marketing

Learning how to generate demand won’t come easily. Most nonprofits and funders optimistically operate on a widely held assumption about their services: build it and they will come. Often, however, they don’t—at least not in sufficient numbers. Demand often falls short of expectations. So what does it take to close the gap?Insight about how nonprofits can do a better job of attracting customers comes from the decades of research and practical application of the theory of “diffusion of innovation.” The theory was first put forward by Everett Rogers (then an assistant professor of rural sociology at Ohio State University), who in 1962 published Diffusion of Innovations, a groundbreaking book that seeks to explain how, why, and at what rate innovations spread through groups of people. A wide range of for-profit companies continue to draw on Rogers’ work to shape their strategies around product design, customer segmentation, and sales.

In one of his famous examples, Rogers told the story of a Peruvian public health agency that sent an employee to live in a remote village to teach locals how to boil water to avoid a number of health risks. But the effort failed for several reasons. Surprisingly, boiling water conflicted with villagers’ beliefs. The first villagers targeted for training turned out to be unlikely to adopt boiling water as a practice or to influence others to do so. The health agency also dispatched the wrong messenger. It relied on an expert from outside the village to persuade villagers to adopt the practice, when conversations among peers or with a trusted local authority would have been most persuasive.

It turns out that the lessons learned from this failed effort can also help social sector organizations do a better job of designing and marketing services. Nonprofit organizations need to start by recognizing that innovative social programs don’t simply sell themselves. Getting a new idea adopted, even when it has proved to be effective, is often very difficult, but not impossible. There are three critical steps nonprofits need to take when creating and implementing solutions. In the sections that follow, each of these three steps will be explored in detail.

- Recognize the limits of designing a service or program primarily for effectiveness and also design for “spreadability.”

- Go beyond identifying a broad group of potential beneficiaries and focus first on a subgroup most likely to participate.

- Develop and resource a sales and marketing capability from the outset, right alongside budgeting for program delivery.

Design the Service or Program for Spreadability

The first thing nonprofits and social enterprises must do is to make sure that their new service appeals to beneficiaries. It’s not enough that the service is proven to work; it must also be something that people want. With the rise of the “what works” movement, funders and nonprofits alike have focused on building an evidence base to prove that programs deliver on their promises. Even the federal government, the largest funder of nonprofits, now routinely requests evidence of successful outcomes in grant applications.What-works advocates assumed that evidence of impact would fuel the growth of programs to meet the rising need for social services. But the straight line from effectiveness to filling programs to capacity turns out to be a mirage. Evaluation results typically don’t carry much sway among beneficiaries. “There are many things getting in the way of people enrolling in a program, and being told that it is ‘good’ for me is almost never enough to get me to join,” says behavioral science expert Anthony Barrows.

Benilda Samuels, the chief marketing and communications officer of Nurse-Family Partnership (NFP), a home-visiting program for low-income, first-time moms, describes the conundrum: “I believe NFP is the gold standard, but we still have to make the right pitch to sell our program to moms. Moms have a choice, and we have to make our best effort for them to choose NFP. The right pitch has little to do with our amazing program outcomes, and everything to do with selling a solution that meets the immediate, and seemingly insurmountable, need of women who are young, poor, and pregnant for the first time.”

With all eyes on effectiveness, too few nonprofit leaders and funders have taken a hard enough look at whether a program actually appeals to would-be beneficiaries. To understand how nonprofits can better design and market their programs to beneficiaries, it is useful to look at Omada Health, a for-profit company on a mission to spread the diabetes prevention program. Omada has signed up DPP participants rapidly while maintaining consistently high outcomes. It served close to 4,000 people in 2014, its first full year in the market, and expects enrollment to top 100,000 in 2016, five times the number enrolled by all other DPP providers in 2015.

How did Omada excel at DPP growth while others lagged? It made a number of smart design decisions to make its program attractive. For starters, Omada’s DPP program is online, allowing people to sign up in about one minute and immediately begin a lesson. Contrast that with the typical DPP requirement that beneficiaries attend a classroom-based program at a specific time and place—neither of which might be convenient. The online course also appeals to people who feel uncomfortable discussing personal health topics with strangers.

Omada markets its DPP as short and intense—just 16 weeks. Only when someone has nearly completed these 16 weeks does Omada offer an additional six to eight months of maintenance sessions. Contrast this short commitment and voluntary follow-on—a relatively easy sell—with the tougher sell of yearlong classroom participation required by other DPP providers. Omada also encourages prospective participants to test its program via free online demos, a feature that lowers the hurdle for signing up. And it provides a wireless weigh-in and online profile so participants can track and share their progress—increasing the odds that prospective participants will learn about the program by seeing others using it.

In short, Omada designed its program to incorporate effectiveness and spreadability. In doing so, it demonstrated classic principles of the diffusion of innovation theory, which call for designing a program that has the following attributes:

- Better than what exists (both costs and benefits)

- Compatible with beneficiaries’ values, past experiences, and needs

- Simple to use (or do) and understand

- Testable without having to commit to it

- Observable such that others can see the benefit of adopting it

IDEO.org found that young women shy away from being seen discussing or seeking contraceptives. To make accessing contraceptives less of a public affair, IDEO.org suggested that Marie Stopes open pop-up nail salons where the manicurists, trained as counselors, would engage customers in discreet conversations about birth control options. Marie Stopes’ pop-up salons soon had crowds lining up outside their doors as women got their nails done and picked up contraceptives. The salons’ success demonstrates the importance of program design in creating demand.

Target the Group Most Likely to Participate

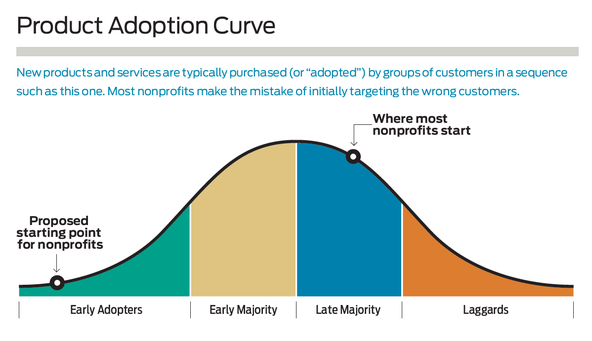

The second thing that nonprofits and social enterprises must do is to better understand the needs and wants of the people for whom the service is designed, and target those groups who are most likely to use the service first. In any group, research indicates that a small number will show interest in a social innovation without much regard for the cost or ease of participating. These are the early adopters. Next is a large swath of more skeptical individuals who prefer something simple and proven, the early majority and late majority. Finally, a small group of laggards will ignore or resist the innovation. Together, these groups constitute the classic adoption curve that illustrates how an innovation grows in acceptance.

It’s easy to see this progression at work in the technology arena. Adoption of the iPhone, for example, got off to a slow start after Steve Jobs unveiled the first smartphone in January 2007. Two years later, only true technology enthusiasts had purchased Apple’s innovative device, leaving the flip phone firmly atop the cellphone market. Today, the iPhone and its competitors have captured the majority of later-stage buyers, and flip phones have all but disappeared—except among laggards—from the market.

What can nonprofits learn from the market segmentation that undergirds the adoption curve? First, it’s important to know whom you are targeting because different adopter categories have different needs and attitudes toward the programs and services created for their benefit. Satisfied early adopters become promoters who, as trusted sources, talk with friends and peers, and help persuade others to follow. Early adopters also help nonprofits increase their revenues, build their infrastructure, and refine their programs and services, making those programs and services even more effective and easier to use. Conversely, targeting all potential beneficiaries at once (or the equivalent, targeting none specifically) is inefficient and often ineffective.

One of the additional hurdles that many nonprofits face is that not all those in need of a particular social program or service, as important and potentially life changing as it may be, are equally prone to adopt it. In their book, Scarcity: Why Having Too Little Means So Much, behavioral scientists Sendhil Mullainathan and Eldar Shafir explain that people coping with poverty focus on the now and not the future. The poor live with a “scarcity mindset” that causes “tunneling,” a condition that drives them to focus on only the most urgent matters before them. This stacks the odds against participation in services that don’t address immediate needs. Scarcity also leads to reduced mental bandwidth to process all the important factors in making a decision. The impact of scarcity on behavior underscores the need for nonprofits to segment beneficiaries by likelihood of participating in a given program.

This is one of the reasons why Omada Health has targeted only a select segment of the millions of people with pre-diabetes. It recruits employers and people who know they have a problem and are looking for a solution. To do this, it identifies employers above a certain size in industries with a high prevalence of overweight employees covered by health insurance. These employers understand that they save on health premiums if their workers avoid diabetes, so they welcome Omada’s program. Omada then works to sign up employees who know they are at risk of developing diabetes, a task made easier because of their employer’s support and access to health insurance coverage. (Only now, three years in, has Omada begun limited efforts to target harder-to-reach people served by Medicaid. It recently started a 300-person, philanthropy-funded clinical trial with Medicaid participants.)

The nationwide spread of cardiopulmonary resuscitation (CPR) also demonstrates the power of targeting the early adopters, and the drawbacks of starting too broadly or picking the wrong segment. CPR was an instant game changer for cardiac arrest victims when it was developed in 1960. For a decade, however, CPR did not advance beyond a small group of medical providers working in medical facilities. Promoters of CPR next looked to scale by training volunteer firefighters, a group that eagerly embraced the practice, but one with limited reach. The real breakthrough came years later when a doctor began training 911 dispatchers to instruct callers to administer CPR. Those dispatchers became the springboard to training thousands of callers across the country—the ultimate example of a sizable group with a problem in need of a solution. It’s now estimated that about 18 million people, both health-care professionals and lay people, are trained in CPR each year.[2]

Targeting early adopters isn’t for every nonprofit. It works best for those attempting to spread a new, innovative program or service. It does not come into play when an intervention fills an emergency need—for example, in disaster relief after catastrophic storms or public health emergencies caused by infectious diseases. In those cases, all those in need know they have a problem and are looking for a solution. It also does not fit in situations where the intervention is no longer perceived by beneficiaries as an innovation, such as food banks and homeless shelters. Nonetheless, a large number of nonprofits and social enterprises could benefit from thinking differently about which potential beneficiaries to target first.

Build Sales and Marketing Capability

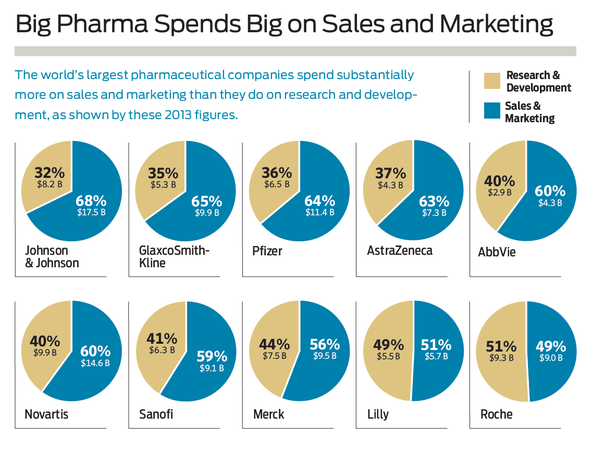

The third step that nonprofits and social enterprises must take is to develop a strong sales and marketing capability. It’s not enough to create a service that people want, and target the service at people most likely to use it. Organizations also need to reach out to those people and entice them to use the service. This is something that for-profit businesses have understood for decades.Take for example the pharmaceutical industry, a paradigm both of innovation for social good and of marketing savvy. Getting a drug to market typically requires a 12-to-15-year journey to establish its efficacy and safety. But even with proven remedies that meet demonstrated needs in the populace, 10 of the largest pharmaceutical companies spent nearly $100 billion in 2013 to market their products. In fact, in an industry whose fortunes depend on research and development, these firms spent $33 billion more on marketing than on R&D in 2013.

While Omada’s program design makes it easier to sign people up, Omada cofounder Sean Duffy still affirms the need for a sales force. “Nothing can sell itself,” says Duffy. “It doesn’t matter how good the product is. Without a deliberate go-to-market strategy, it won’t work.” For Omada, this belief affects how it invests its resources. The company employs 55 salespeople, a quarter of its staff. “There’s nothing atypical about what we’re doing compared to a classic enterprise sales organization,” says Duffy.

A robust sales force has made the difference for nonprofits as well. After a team of US academic and government researchers confirmed in 1971 that a mixture of water, salt, and sugar, called oral rehydration, could halt the ravages of cholera-induced diarrhea, the remedy remained largely unused for years. Only when BRAC, a Bangladesh NGO, recruited and deployed thousands of workers to teach villagers why they should use the oral rehydration solution, and how to make it out of ingredients on hand in even the humblest of homes, did adoption take off in the early 1980s. As with Omada, the simplicity of the formula hastened its adoption. In a few short years, oral rehydration therapy became the new norm for treating cholera and the broader group of diarrheal diseases.

BRAC’s success underscores the value, even for nonprofits, of investing in sales. In some cases, nonprofits will need to hire a sales staff of their own. In other cases, they may be able to hitch a ride with a partner’s sales force rather than build their own. Such was the case for MicroEnsure, a for-profit social business that sells life and health insurance to low-income people in Africa and Asia. MicroEnsure faced an uphill battle. First, it would have to build awareness of the need for insurance. Then it would have to persuade people to buy it, knowing that insurance would be a hard sell for families worried about their next meal. So MicroEnsure went a different route. It sold its products to AirTel, a leading telecom provider that used the insurance as an incentive for customer loyalty. This solved MicroEnsure’s sales force problem while boosting AirTel’s customer retention in one deal. The partnership helped MicroEnsure achieve the same growth as its leading counterparts in a quarter of the time, and it helped AirTel to boost revenue by at least 10 percent by cutting subscriber churn.

While many nonprofits would likely agree with the value of building sales and marketing capabilities, it can often be difficult for them to find the funding to do so. Deeply held beliefs govern how nonprofits spend the money they raise. These beliefs emphasize delivery of programs and services, the heart of any nonprofit’s mission, while causing them to scrimp on functions vital to sustaining an organization, including sales and marketing. Funders can help nonprofits to overcome insufficient demand by viewing demand-generating activities as extensions of programs or services and funding them in the same way.

Taking the First Steps

It’s time that nonprofits and funders begin to pay as much attention to selling social programs and services as they do to creating programs that have a strong evidence base and are proven to work. Selling social change means ensuring that the program’s design isn’t just effective but also spreadable; identifying and describing target beneficiaries most likely to participate in the program or service; and allocating sufficient resources to deploy a viable sales and marketing effort.

Doing these sorts of demand-generation activities, however, is unfamiliar territory for most nonprofits. But a range of options exists for those who want to get started. One way to begin is to answer three questions during your organization’s next strategic planning process or new program design process:

- How will you ensure that your program or service receives high scores from beneficiaries on these dimensions: better, compatible, simple, testable, and observable?

- What segment of those you hope to serve knows that they have a problem and are looking for a solution?

- Who will sell your innovative program or service to potential beneficiaries?

Nonprofits that need additional help can contract with one of a growing number of consulting firms addressing specific components of social sector sales and marketing. Human-centered design firms, like IDEO.org, can help nonprofits to understand the attitudes and desires of their beneficiaries and redesign their programs to satisfy those desires. Behavioral science firms, like ideas42, can help nonprofits to understand the barriers that keep their beneficiaries from taking action, and make small tweaks to programs or communications to enable beneficiaries to more easily act on their intentions. And strategic marketing firms, like The Populist Agency, help design and deploy creative tools that influence beneficiary behavior and drive service use or product sales.

What all of these organizations have in common is the ability to help nonprofits and their funders to see past the need-equals-demand fallacy. Only when that happens can they get comfortable with the idea that selling social change is a vital link in the social sector’s quest to achieve breakthrough results.

Notes

[1] In fall 2015, The Bridgespan Group asked nonprofit leaders who participate in its LinkedIn groups to comment on whether they had encountered challenges recruiting sufficient numbers of participants for their programs. Eighty-five leaders responded to the survey.[2] "About CPR and First Aid,” American Heart Association.